Click here to read the original Cautious Optimism Facebook post with comments

6 MIN READ - The Cautious Optimism Correspondent for Economic Affairs and Other Egghead Stuff closes out his now finished series on inflation and deflation fallacies by saying a few words about Modern Monetary Theory (MMT) and some of its own fallacies that relate specifically to inflation (preview link for illustrative purposes).

|

| MMT proponent Stephanie Kelton |

CO himself has posted many articles about MMT over the last year or two, and now that neither Bernie Sanders nor Alexandria Ocasio-Cortez will be sworn in as president anytime soon, the media’s recent MMT blitz has thankfully died down.

There’s no shortage of problems with MMT to criticize, but today's focus is a particularly gaping contradiction in the theory that he hasn’t yet heard articulated by other economists. That said, as much as he’d like to think he’s happened upon an original idea, someone else has probably thought of it already so anyone in CO Nation who happens to find it elsewhere please feel free to post in comments.

MMT’S OPEN SESAME: NO TAX HIKES?

Two of the many policy soundbites that MMT’ers like to recite are:

“A government can no more run out of dollars than a carpenter can run out of inches”

...and...

“Taxes don’t finance government spending”

The first (dollars, carpenters, and inches) is meant to convey that so long as a government controls the issuance of its own sovereign currency and has few debt obligations in another currency (which qualifies the USA, UK, Japan, Canada, Australia, etc…) then it can never run out of money.

Ironically, a carpenter may not be able to run out of inches either, but he can easily run out of wood which perfectly exposes a huge problem with the “can’t run out of dollars” jingle. That is, yes a government can print money ad infinitum but that doesn’t lead to the creation of real physical resources ad infinitum. There may not be a dollar restraint (actually there is as we’ll see) but there is always a real resource constraint.

Sophisticated MMT proponents such as economists Stephanie Kelton and L. Randall Wray are aware of the resource constraint problem, but promote the slogan anyway which their less informed readers then repeat in social circles and online.

The second soundbite (“taxes don’t finance government spending”) is a paradoxical proverb meant to convey another novel MMT insight: governments can simply instruct their central banks to create and lend them all the money they wish to spend, and taxes only serve the purpose of ensuring the currency’s continued use since governments can require/force their citizens to pay their taxes in that currency. Hence, the public can never completely refuse to use the money and governments can finance their spending programs with borrowing from the central bank’s fountain of paper instead of new taxes or spending cuts (those two fiscal tightening methods being so politically difficult to sell to the public).

Put these two together and we now have the foundation behind the third and crucial MMT claim:

“We can have a Green New Deal, universal basic income, universal socialized medicine, free college education, a government high wage job guarantee, and all sorts of other expensive progressive goodies without raising taxes.”

Not only is this one of MMT’s linchpin selling points, as it promises a huge something for nothing, but it also lays the groundwork for one of the MMT’ers’ favorite rhetorical traps.

When MMT’ers declare the government has no constraint on spending for programs that will literally cost dozens or even hundreds of trillions of dollars—from a current federal budget of only about $4.4 trillion annually—and skeptics retort that “you’ll have to raise taxes sky high to pay for all that,” they savor the opportunity to pounce on the uninformed neanderthals: “Don’t you realize taxes don’t pay for government spending?” The Economics Correspondent has seen many an MMT disciple beam with self-satisfaction believing they have stumped their opponents with such an intricate enigma.

So let’s assume this claim is correct—that government doesn’t have to raise taxes but can still provide a gigantic cornucopia of expensive social programs through massive moneyprinting and borrowing. And whenever debt loads appear to be getting too high, it’s no problem because “a government can never run out of dollars” and the central bank will keep lending whatever it takes to service the debt.

INFLATION

The obvious problem with this theory—quickly recognized by even the layman—is that the moment government spends the new money and it enters circulation the economy will experience price inflation. And when confronted with this problem, many MMT’ers will claim that their visionary form of government financing isn’t inflationary.

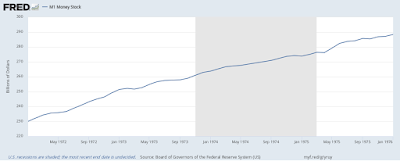

One response they use draws from traditional Phillips Curve Keynesianism: If the economy is not at their definition of full employment (which is far below the conventional 5% definition) and idle capacity still lies unused, all that new money won’t be inflationary because it will stimulate more production. Now we already saw that theory flop during the 1970’s stagflation era but let’s grant them for the moment that they really can print away with no consequence so long as unemployment remains above their definition of full employment.

Once their definition of full employment is reached, MMT’ers will argue that there’s still far more room to print money without inflation because everyone is underestimating the extent to which government can stimulate more production with all its deficit spending. Although given that inflation reached double digits in the 1970’s even with stubbornly high unemployment, I’m not as willing to just accept that claim as an article of faith.

The Economics Correspondent was even told once by an online MMT sycophant that printing money isn’t even a source of inflation at all. When confronted with the Equation of Exchange (mv = py) he simply declared the formula invalid without providing a shred of evidence. That’s all it took. Like saying “The law of gravity is not valid, let’s all jump off the Brooklyn Bridge now that I’ve proven there’s no danger.” With the wave of his hand, this one ingenious commenter single-handedly overturned a law of monetary economics that no academic has been able to disprove for well over a century.

BTW, sophisticated academic MMT’ers don’t argue that money doesn’t cause inflation or that the Equation of Exchange isn’t valid “because I said so.” This is also the domain of their fervent disciples.

That said, when you press MMT’ers hard enough, especially the trained academics, they will finally admit that there are limits to how far a government can go printing money before inflation becomes a problem. They rarely express this limitation voluntarily, preferring to lead their followers into believing the printing press can deliver endless gifts to society, and one often has to push and push and push the issue and not let it go like a pit bull.

But eventually after enough persistence they will finally concede “Well OF COURSE there are real resource constraints. We would never say you can print money forever without eventually causing inflation.”

EVEN INFLATION IS NO PROBLEM. REALLY?

Once an academic MMT’er is forced to admit that there is a limit to how much money the central bank can print and lend to the government before inflation becomes a problem the remedy, almost as if automatically on cue, is “But if inflation becomes a problem, government can always tax the money out of the economy to restrain price pressures.”

As evidence:

“Taxes are one tool governments can use to control inflation. They take money out of the economy, which keeps people from bidding up prices.”

-“Modern Monetary Theory, Explained,” Vox

“Government taxes can be used to keep inflation under control, to control our behaviour (via fees and levies and rates), and to get us to produce things the government needs.”

-“ Modern Monetary Theory: How MMT is challenging the economic establishment,” ABC News Australia

OK we’ve almost reached the punchline. Up until now this is standard MMT doctrine and every economist who has scrutinized MMT has heard this line of reasoning. The final closing criticism is up next:

So as we’ve seen, the big marketing promotion for MMT, perhaps *the* biggest, is that we can have our cake and eat it too. Washington can spend $100 trillion, even $200 trillion on Green New Deals, socialized medicine, free college, universal basic income, and every other democratic socialist’s dream program “without raising taxes or cutting spending.”

But when MMT’ers are pushed hard enough on the inevitable (they say it’s not inevitable, but it is) consequence of higher inflation, they say “Not a problem because government can tax the money out of the economy.”

And therein lies the gaping hole. In the end, the free lunch proposition is false. Ultimately all the programs will require higher taxes after all—despite their promises that taxes don't have to rise—only with the added central bank middleman that prints gobs of money first.

MORE DREAMING

And if anyone thinks those tax hikes will be tiny think again. During the stagflation 1970’s, a monetary expansion that will be small compared to what MMT’ers want for their enormous social programs, inflation hit 15% during some years. If prices rise 15% a year, imagine how large a share of the entire money supply Congress will have to remove through taxation to stop it—and the size of tax hikes needed to do it.

For perspective, consider that federal tax revenues today constitute about 16% of nominal GDP, yet 100% of GDP this year would become 117% or 118% in nominal terms next year, mostly due to inflation. So to get nominal GDP down to a more reasonable level of 102% or 103% of the previous year (this assumes MMT’ers don’t produce a recession with their inflation and taxes), 15% to 16% of nominal GDP will have to be taxed out of the economy atop the 16% of GDP Washington already taxes today.

The math is a little more complicated than just adding fifteen points to the tax rate but yes, Americans’ federal tax burden would nearly double across the board just to control an inflation that will appear tiny compared to what MMT’ers will produce.

In fact, historically every time governments have resorted to the printing press to pay for spending programs they quickly lose control of prices and inflation reaches rates of 25%, 50%, 100% per annum or even higher. To stop a price inflation of 50% per year, Washington would have to tax away a full one-third of nominal GDP on top of the current level of taxation, year after year after year.

And the higher monetary velocity rises, the logical consequence of rising inflation, the greater the share of the money supply the government will have to tax away to get prices under control.

Who knows, perhaps a huge tax hike is really the secret endgame of some MMT proponents. After all, MMT’ers are heavily aligned with ultra far-left progressive movements and even Paul Krugman accuses them of going too far with their big government largesse.

And there’s two more problems with the MMT panacea of taxing inflationary money out of the economy: First, it assumes Congress can even find the wherewithal to raise taxes without being thrown out of office. Raising taxes under MMT will be more politically unpopular than it is now. How many politicians will tell their constituents, already angry at rising prices, that their taxes are going up?

And assuming Congress and the White House can get the tax hikes passed without a revolt then the second and probably most preposterous assumption is that once Congress gets its hands on a huge share of the nation’s money supply elected politicians will dutifully destroy the money in the name of fighting inflation.

Anyone who thinks Congress and even presidents, when given trillions or even tens of trillions of new dollars in tax revenues to play with, won’t resort to spending it to subsidize their districts and buy votes needs to have his head checked. In fact, the Correspondent predicts that the least disciplined and most profligate spenders of that new tax revenue will be the MMT proponents themselves—the likes of Bernie Sanders, AOC, Ilhan Omar, and the rest of The Squad.

So the final result of MMT will be the worst of both worlds: higher taxes *and* higher inflation.

CATO monetary economist George Selgin, of whom the Correspondent is a huge fan, likens MMT’ers to road show salesmen promoting their latest perpetual motion machine. They promise limitless mechanical motion and energy, but when you ask them about the wire running under the tablecloth into the wall they assure you it’s nothing important. If you continue to press them hard enough and force them to answer, eventually they admit it’s an electrical cord but that it doesn’t change the novelty of their new invention. In the end, according to Selgin: “There’s nothing new that’s true, and nothing true that’s new in MMT.”