Click here to read the original Cautious Optimism Facebook post with comments

|

| Milton Friedman (1912-2006) |

“Gas prices… …were up more than a dollar above [Ukraine] pre-invasion level. That roughly 25% increase in prices will drive tomorrow's inflation rating.”-Jen Psaki, White House Press Secretary (April 11, 2022)

“If the government can, it will blame external sources [for inflation]—my own government has tried to put the blame on the Arab Sheiks who raised the price of oil.”

-Milton Friedman (1975)

7 MIN READ - The Cautious Optimism Correspondent for Economic Affairs and Other Egghead Stuff explains in detail why rising oil prices have never caused high inflation in American history, and why rising oil prices aren’t the cause today either.

It seems every day now we hear the blame for inflation laid at the feet of oil prices—by Joe Biden and other government officials, by Federal Reserve Chairman Jerome Powell, by liberal and even some conservative economists, by the traditional media, and even from business news outlets.

During the western world’s stagflation era of the 1970’s, Milton Friedman disparaged the government’s official excuse for inflation: that an oil price shock was responsible for the decade’s rapid price increases.

But how could Friedman have possibly believed that? Isn’t it true that higher oil prices bleed over into an endless list of other products and services that use oil as an input? And that higher oil prices drive all their prices up too, creating inflation?

In the Economics Correspondent’s opinion, it’s understandable that many in the public might view this explanation as plausible. But it’s sad that decades after settling this question so many in the economics profession and business news community are still falling for and promoting a fallacy.

Let’s explain.

INFLATION: ONLY THREE CAUSES

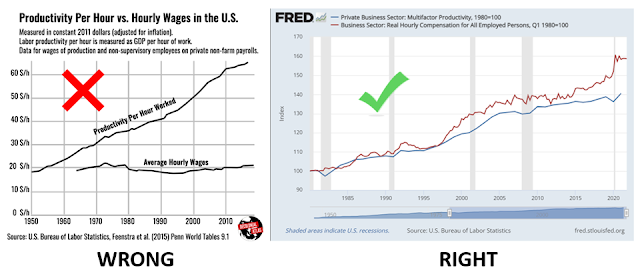

In 2020 the Economics Correspondent posted several articles on inflation where he stressed the value of the monetary Equation of Exchange which explains price movements. The Equation of Exchange has been around in written form for over two centuries, in mathematical form since 1911, and it has yet to be overturned today.

According to the equation only three variables can raise the overall price level in an economy (ie. cause inflation):

1) An increase in the money supply, known to many as too much money chasing too few goods

2) A reduction in the quantity of goods and services, known as the same amount of money chasing fewer goods

3) An increase in the pace at which each unit of money is spent instead of hoarded (velocity)

Or in mathematical terms, mv = py.

If we isolate prices, the equation becomes p = mv/y.

Velocity plunged in the second quarter of 2020 during the nationwide Covid lockdowns but has remained nearly constant ever since. So we can simplify and remove v from consideration for now.

OK, so how do the remaining two variables somehow prove higher oil prices don’t drive rapid inflation?

We’ll look at empirical evidence in a moment, but if the supply of money is held constant and consumers and businesses are forced to pay more for oil and oil-based products then they will necessarily have lower cash balances remaining to buy everything else. The lower cash-demand for other products will drive an offsetting reduction in the prices of other goods and no change in the overall price level.

But it’s important to note this holds true only if the central bank doesn’t increase the money supply at the same time.

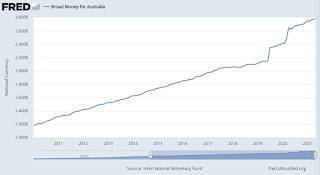

Of course this is not the world we live in. Our central bank, the Federal Reserve System, quietly and insidiously inflates the money supply consistently year after year and has increased it by 44% since February of 2020.

Hence in the real world where the money supply grows constantly, when oil prices rise consumers and businesses not only pay more for energy and oil-based products, but they also manage to hold large or even larger remaining cash balances (courtesy of the Fed) to buy other goods whose prices also rise, and we get inflation.

And government bureaucrats blame rising oil prices for the inflation, not the swelling money supply that facilitates it. As Milton Friedman said in 1977:

"All other alleged causes of inflation—trade union intransigence, greedy business corporations, spend-thrift consumers, bad crops, harsh winters, OPEC cartels and so on—are either consequences of inflation, or excuses by Washington."

OK this idea of “less money left to buy other products” might sound workable on paper. But is there any real evidence for this theory?

EMPIRICAL EVIDENCE

There’s no shortage of exhibits that contradict the “higher oil prices cause high inflation” narrative.

Let’s start with an easy one. During the 1970’s the government blamed rising oil prices for inflation virtually every day.

OK, so if rising oil prices were the culprit, then when oil prices collapsed in the 1980’s the overall price level should have correspondingly fallen. After all, it was oil that sent prices rising, so remove that factor and prices should go down.

Is that what happened in the 1970’s and 1980’s?

Of course not. We all know it.

The OPEC embargo did send oil prices soaring. From 1974 to 1980 oil rose from $10.11 to $40 a barrel.

Oil prices then collapsed in 1986, falling all the way back to $10.42, nearly the same price as in 1974.

So if oil was really to blame, then the overall price level at the end of 1986 should have fallen back to 1974 levels.

But it didn't. By the end of 1986 the Consumer Price Index was 137% higher than in early 1974 (source: St. Louis Federal Reserve). This despite real GDP having expanded 46% in the same period, meaning prices should have fallen not only to 1974 levels, but another 32% further.

In fact even in 1986, when oil prices underwent their spectacular collapse, the CPI didn’t even fall within that single year, rising by 1.4% instead. According to the oil price argument, prices should have plunged in 1986.

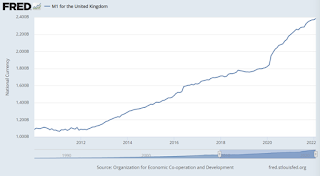

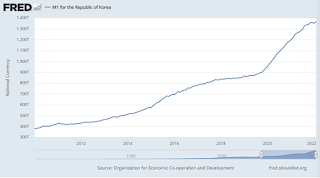

What was the culprit for the stubborn inflation in the face of collapsing oil prices? The only remaining factor: the money supply. From 1973 to 1986 the money supply as measured by M1 rose by 190%, nearly tripling in thirteen years. Velocity also rose modestly, up 16.9%.

Just as Milton Friedman argued throughout his career, money was to blame.

How about other oil price spikes? When Saddam Hussein invaded Kuwait in 1990 and early 1991 oil prices more than doubled, a faster increase than we’ve seen in 2022. Given that today we’re reading about 8.5% or 10% price hikes, the inflation rate must have reached into the teens, right?

Nope. In 1990 and 1991 the CPI rose by 5.5% and 2.7% respectively.

The culprit? Once again money. Through 1990 and 1991 M1 increased by 14.4%.

Oil prices over tripled from 2009 to 2011, from the nadir of the Great Recession into its slow recovery. The inflation rates in 2009, 2010, and 2011 were 2.8%, 1.4%, and 3.1%.

During those same years M1 increased by 5.7%, 8.5%, and 17.9%.

Whatever inflation the country experienced, mild as it was considering the doubling and tripling of oil prices, was due entirely to the central bank’s figurative printing press, not oil.

IS THERE ANY WAY IT CAN BE OIL AT ALL?

OK, so a logical next question might be “Come on Cautious Optimism Correspondent, surely there can be a big enough oil price surge that affects everything else enough to cause high inflation on its own, right?”

Well yes. Although that has never happened in U.S. history, it could happen in theory—just not for the fallacious reasons the media tell us.

Let’s say oil goes to $1,000 a barrel tomorrow. Assuming monetary factors are held constant by the central bank, consumers and businesses who are forced to pay such astronomical prices would again have less money, a lot less money, left to buy everything else, lowering non-oil sector prices accordingly. Ie. no inflation.

That part is still true, but…

The prices of other products would fall so sharply that firms record losses and start cutting back on production.

If the scarcity of oil becomes so acute that the overall economy’s output turns negative, then the “y” variable in the Equation of Exchange—output of goods and services—falls and finally becomes inflationary. That is, oil as an input becomes so scarce that some businesses somewhere can’t get enough of it to support their operations and are forced to cut back supply.

Now we have the same number of dollars chasing fewer goods.

Economists with a more sophisticated understanding of inflation will sometimes say “If oil prices rise enough to harm output then we could see higher inflation.” That’s a valid mechanism.

Unfortunately the invalid mechanism is the one that gets far too much press today: “If oil prices rise the cost will push through into everything else, raising inflation.”

The first phenomenon can happen in reality. The second cannot, unless once again the central bank inflates the money supply at the same time.

So are oil prices rising quickly enough right now to reduce overall output and drive the high inflation we’re all experiencing?

That’s easy. The answer is no. Because if oil prices were really forcing a pullback in the supply of goods and services for the last year that would meet the official definition of a recession: at least two consecutive quarters of contracting output.

Over the last 12 months Americans have seen prices rising by 6%, then 7.5%, then 8.5%, but output and real GDP haven’t been contracting. They’ve been rising. High oil prices driving output into reverse is not the culprit.

The fact that the U.S. economy has spent 90% of the last 40 years in expansion also automatically disqualifies 90% of recent history from any conversation where economists might try to blame higher oil prices for inflation.

OK, admittedly we did get a surprise last week: the BEA reported that GDP contracted by a 1.4% annualized rate in the first quarter (equal to -0.35% for the single quarter), so we may be on the cusp of entering a recession soon. But one recent quarter can’t explain an entire year of rising prices, and it’s mathematically impossible for an 8.5% annualized increase in prices to be caused by only a 1.4% annualized reduction in output.

In 2022 the culprit once again is money. In the last twelve months the money supply measured by the Fed’s new definition of M1 has increased by 11.1%, something you’ll never hear Jen Psaki mention.

So it starts to become clearer now why Milton Friedman famously said:

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

Note: All data sources from the St. Louis Federal Reserve. Anyone who wants links to any of the M1, velocity, CPI, or real GDP indexes can request it in the comments section.