Click here to read the original Cautious Optimism Facebook post with comments

2 MIN READ - The Cautious Optimism Correspondent for Economic Affairs and Other Egghead Stuff believes the Bank of England is being more forthcoming with the British public about the potential repercussions of suppressing inflation than the Federal Reserve has been.

That said, there are some slightly different circumstances at play in the UK.

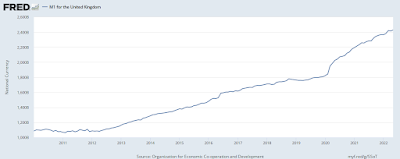

1) The UK's official reported inflation rate is slightly higher than the USA’s at 9.4% (June). During the pandemic the Bank of England expanded money just as aggressively as the Federal Reserve and also kept its policy rate too low well into 2022 (see M1 chart).

Given the BoE only raised its policy bank rate (similar to the Fed’s discount rate) from 1.25% to 1.75% last week, there’s an argument to be made that its policy rate still remains too low even eight months into the year (see bank rate chart), that it's even further behind the curve than the Fed, and that it's more motivated to risk recession in order to stop inflation.

2) Bank of England officials are publicly forecasting inflation to reach 13.3% later this year. Central bank rate hikes can influence price movements faster than the real economy, taking several quarters before their effects are fully felt on growth and employment—what Milton Friedman called "long and variable lags"—another risk Americans should consider since the Fed's recent 150 basis points in rate hikes have only occurred in the last 50 days.

3) The Bank of England may be trying to prepare the British public for a “worst case scenario” in the hopes of exceeding lower expectations in the future.

The Fed, on the other hand, may be opting for a different political path: talking down any major recession risks in the hope it can still engineer a “soft landing.”

While there's no guarantee an inflation-suppressing tightening will create a recession a year later, history has shown that soft landings are nearly impossible to achieve when attempting to stop any inflation above mid-single digits... as the Economics Correspondent has previously written about (see attached article).

http://www.cautiouseconomics.com/2022/06/monetary-policy-24.html

Read more on the Bank of England's warning on CNBC at:

https://www.cnbc.com/2022/08/04/bank-of-england-launches-biggest-interest-rate-hike-in-27-years.html

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.