Click here to read the original Cautious Optimism Facebook post with comments

"I don’t think that [2018 rule changes] had any effect. I don’t think there was any laxity on the part of regulators in regulating the banks in that category, from $50 billion to $250 billion.”

-Barney Frank, co-author of the 2010 Dodd-Frank Act

7 MIN READ - The Cautious Optimism Correspondent for Economic Affairs and Other Egghead Stuff finds himself in the predictable position of warding off zombies already blaming “Trump” and “deregulation” for SVB’s collapse.

|

| Chris Dodd and Barney Frank |

So with all the news about SVB’s failure the Left and the press (sorry, I repeat myself) have once again become overnight banking virtuosos and are already blaming Trump and deregulation for the bank’s collapse.

In the nation’s capital Senator Elizabeth Warren has complained SVB would never have failed were it not for Trump’s 2018 partial rule changes to some aspects of the 2010 Dodd-Frank Act, even as she’s been trying yet again to expand the Community Reinvestment Act to force a whole new set of institutions beyond just banks to grant large mortgage loans to low-and-moderate income borrowers. (Anyone remember 2008?)

Meanwhile one of Forbes’ token pro-climate change, pro-more regulation columnists was hair-trigger quick to jump on the SVB failure as an opportunity to blame “Trump’s deregulations” too.

SVB failed on Friday and by Sunday morning Maya Rodriquez Valladares’ article was already pointing fingers.

You can read “How Trump’s Deregulation Sowed The Seeds For Silicon Valley Bank’s Demise” at:

However after reading over the specific deregulations Valladares blames (I’ll refer to her as Valladares, not Rodriguez), it appears she was in such a hurry to blame Trump that she didn’t even check if the changes in bank supervision rules she cites had anything to do with SVB to begin with.

In fact, nearly every change she cites—many of which are being repeated all over the Internet and in the press—never applied to SVB, and the one change that did apply didn’t matter since SVB was already voluntarily complying with even higher standards at the time (more on that in a moment).

FIVE COMPLAINTS

Nearly all of Valladares’ complaints have to do with Trump signing a 2018 law that raised the asset limits that subjected larger banks to stricter reporting or stress test rules.

Keep in mind as you read these grievances that in its last SEC-filed financial report—the December 2022 10-K—SVB Financial Group held $211.8 billion in assets.

From Valladares:

“Thanks to Trump and his supporters this all changed. Some of the key changes that EGRRCPA [Economic Growth, Regulatory Relief, and Consumer Protection Act] made were:”

1) “Immediately exempting bank holding companies with less than $100 billion in assets from enhanced prudential standards imposed on SIFIs under Section 165 of the Dodd-Frank Act.”

This rule was irrelevant because SVB had more than $100 billion in assets, not less, and not only when it failed but also going back to late 2020.

Non-sequitur #1.

But not to worry, Valladares also points out that other changes included:

2) “Exempting bank holding companies with between $100 billion and $250 billion in assets from the enhanced prudential standards.”

OK, between $100 and $250 billion. That includes SVB. She must be onto something here, right? Well, just what are those “enhanced prudential standards?” Read on.

“This would then allow national bank regulators like the Federal Reserve to impose what are called enhanced prudential standards. These include rules about:”

“-capital, which purpose is to sustain unexpected losses,”

“-liquidity, including calculating the liquidity coverage ratio (LCR) and liquidity stress tests, and”

“-bank resolution plans, referred to as living wills.”

So without those enhanced standards SVB must have let their capital and liquidity ratios slide into dangerous territory, right?

Not if you actually bothered finding the numbers in SVB’s 10-K.

Starting with capital ratios, the bank’s ability to cover losses, regulators required SVB to maintain what are called CET1 (Common Equity Tier) and Tier 1 risk capital ratios that exceed 7.0% and 8.5% respectively.

In December 2022 SVB’s CET1 and Tier 1 risk capital ratios were 12.05% and 15.40%.

But wait, Valladares says the requirement was lowered by Trump's rule changes. SVB should have been treated like a bigger bank and subjected to higher capital ratio requirements.

Well fortunately for us we can compare SVB’s capital ratios against those of America’s very largest, and according to Valladares most strictly regulated, “Big Four” money center banks at the end of 2022.

(URL links to SVB’s 10-K and the Big Four banks in the comments section)

CET1 and Tier 1 capital ratios:

-SVB: 12.05% and 15.40%

-Wells Fargo: 10.60% and 12.11%

-Bank of America: 11.2% and 13.0%

-Citigroup: 13.03% and 14.80%

-JP Morgan Chase: 13.2% and 14.9%

Unfortunately for Valladares SVB’s CET1 capital ratio was already higher than two of America’s “Big Four” national banks that comply with those stricter standards, and its Tier 1 capital ratio was higher than all four.

Non-sequitur #2.

3) How about the liquidity coverage ratio?

It’s true that being under the new $250 billion limit SVB wasn’t subject to as strict rules about liquidity as banks over $250 billion.

But let’s look again at their 10-K.

It states SVB was not required to publish its official liquidity cover ratio (LCR) which upsets Valladares.

OK, LCR calculations are complicated, but the definition of the LCR is "the requirement whereby banks must hold an amount of high-quality liquid assets that's enough to fund cash outflows for 30 days."

SVB lost one-quarter of all its deposits ($42 billion) in a single day. For Valladares to suggest regulators setting a slightly higher LCR would have allowed SVB to hold up to that kind of mass exodus for a month—without government or Fed help—is simply fantasy.

And we can measure SVB against larger banks using common liquidity metrics and compare their liquid assets (cash, repurchase agreements, and liquid securities) against their most liquid liabilities (deposits).

Liquid assets/deposits ratio (with liquid assets, deposits):

-SVB: 75.8% ($131.2B and $173.1B)

-Wells Fargo: 52.5% ($724.0B and $1.383T)

-JP Morgan Chase: 68.9% ($1.613T and $2.340T)

-Bank of America: 85.8% ($1.657T and $1.930T)

-Citigroup: 92.0% ($1.257T and $1.366)

So at least by a liquid assets-to-deposits measure, SVB was more liquid than two of America’s “Big Four” money center banks whose liquidity rules Valladares bemoans would have averted SVB’s collapse.

Non-sequitur #3.

4) “Limiting stress testing conducted by the Federal Reserve to banks and bank holding companies with $100 billion or more in assets.”

This is the only complaint of Valladares that actually has a bit of grey area, and she proceeds to omit lots of details unfavorable to her case.

They won't be suppressed here.

SVB had assets of $212 billion, and its assets were greater than $100 billion going back to late 2020.

The legislation signed by Trump gave the Federal Reserve the power to conduct stress tests for institutions above $100 billion but the regulators themselves—the Federal Reserve consulting with the FDIC and OCC—decided to conduct stress tests on banks between $100 and $250 billion every two years and not require them to meet the more stringent liquidity rules for giant banks.

Valladares leaves out regulators at three different agencies making that decision because it had to be Orange Man.

SVB crossed the $100 billion asset threshold in late 2020 and would have been subject to a stress test in late 2022 but that happened just after the last 2022 testing date, pushing their first test into 2023.

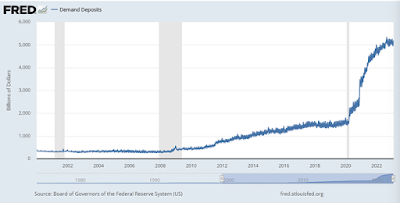

Meanwhile in between 2020 and 2022 the Fed inflated the money supply by a spectacular $7 trillion, swelling the U.S. banking system’s deposits and assets at a record pace including SVB’s which surged to $212 billion or doubling by the end of 2022.

The Correspondent highly recommends viewing the Fed’s own chart of banking system demand deposits after 2020.

Which really narrows down Valladares’ long list of non-sequiturs to just one argument: “If only there had been a stress test, SVB wouldn’t have failed.”

Of course what’s also implied in her only argument, but which she won’t come out and say is: “And the stress test would have foreseen its special niche Silicon Valley tech startup customers substituting deposits for evaporating VC capital, and also predicted Peter Thiel and other VC moguls telling everyone across social media to pull one quarter of the bank's deposits in a single day before it could even raise capital.”

Sure.

Not a non-sequitur but a strikeout nevertheless.

5) Valladares repeats herself somewhat complaining that another change was:

“Increasing the asset threshold for ‘systemically important financial institutions’ or, ‘SIFIs,’ from $50 billion to $250 billion.

Designating a bank as a SIFI—defined as a bank whose failure could directly lead to a systemic crisis due to its failure to meet obligations to other banks—would have triggered those stricter capital and liquidity ratio rules. But we've already covered that SVB was already meeting or exceeding those stricter rules anyway.

Also, there are nearly 50 U.S. banks with more than $50 billion in assets—including regionals Frost Bank of Texas, Zions Bancorp of Utah, and Asian clientele East West Bancorp of California. To call them all “systemically important” would be ridiculous which is one reason the rule changes raised the threshold for SIFI designation to $250 billion to begin with.

Even Valladares admits that “While a failing or failed bank may not destabilize the entire national banking system, it sure can destabilize a region. Just ask California how things are going now with the SVB management-caused chaos.”

Well, important to California is not the same as important to the entire U.S. financial system. Perhaps she should suggest a new designation for “regionally important,” but California is not the entire system no matter what some Californians think.

Quite frankly, to apply the word “chaos” to describe California—other than its pre-existing crime, drug, and homelessness problems—due to SVB’s failure is hyperbole. Sure, there were some tech firms temporarily struggling with paying employees and wondering what other institutions to look to for future capital—at least before SVB reopened with Federal Reserve deposit backstops—but the state's financial industry was not thrown into “chaos" by SVB's failure.

Non-sequitur #4.

(Note: the Federal Reserve did redesignate SVB as “systemically important” over the weekend, not because its failure was creating another 2008 financial crisis, but rather because the status change gave the central bank legal authority to free up more resources to facilitate the SVB’s reopening and protect depositors)

OK that’s it for the list. Keep in mind despite her incessant writing about rule changes, SVB and other U.S. banks are still subject to a multitude of Dodd-Frank regulations which collectively are more stringent and far more onerous than those before 2010. Despite her attempt to convey an image of Trump removing every regulation in the book, he in fact was effectively applying Dodd-Frank rules to all banks with more stringent Dodd-Frank rules to America’s largest (systemically important) banks.

Of course Valladares might have hit closer to the mark had she bothered checking SVB’s financial statements first. The Economics Correspondent is no Forbes columnist but knows how to Google SEC filings for publicly traded banks.

But there’s always that audience out there in half of America that only needs to hear the words “Trump” and “deregulation” to go into a woke stupor and foam at the mouth.

It’s like saying “animal cruelty.” You don’t have to give them specifics. Just say the words and watch them melt down.

====

SEC-filed 10-K reports containing capital ratios and liquidity metrics such as cash, repurchase agreements, securities, and deposits.

SVB (pages 13 and 95)

https://d18rn0p25nwr6d.cloudfront.net/CIK-0000719739/f36fc4d7-9459-41d7-9e3d-2c468971b386.pdf

BofA (pages 51 and 30)

Wells Fargo (pages 6 and 87)

Citigroup (pages 9, 140, 141)

https://www.citigroup.com/rcs/citigpa/storage/public/10k20221231.pdf

JP Morgan Chase (pages 91 and 55)

https://jpmorganchaseco.gcs-web.com/static-files/57c2ed73-8a15-47c2-94f0-e9e29ca87e2c

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.